🏦 USA Bank Loans in 2025: Navigating the Complexities with Confidence

BynambiPublished 87 days ago

Introduction: The Evolving World of Bank Loans

The banking and lending landscape in the United States is rapidly changing in 2025. Advances in technology, shifting economic trends, and tighter regulatory frameworks have transformed how loans are offered, processed, and managed. For borrowers — individuals and businesses alike — understanding these dynamics is essential for making smart financial decisions and avoiding common pitfalls.

1. The Technological Shift in Lending

AI and Machine Learning Take Center Stage

Artificial intelligence is redefining credit risk assessment. By analyzing a wider set of data beyond traditional credit scores — including rental payments, utility bills, and online financial behavior — AI models provide a more comprehensive risk profile. This leads to:

Faster loan approvals

More personalized interest rates

Inclusion of underserved borrowers

However, concerns around transparency and algorithmic bias remain critical.

Digitization and Automation

The loan application process is now predominantly digital, offering:

Instant eligibility pre-checks

Paperless documentation uploads

E-signatures for contract completion

This results in a more streamlined experience and faster access to funds.

2. Regulatory Environment: Balancing Innovation with Protection

Regulators like the Consumer Financial Protection Bureau (CFPB) are focused on:

Ensuring clear disclosure of loan terms and fees

Mandating transparency on AI-driven decisions to prevent bias

Strengthening data privacy standards under laws like the California Consumer Privacy Act (CCPA)

Borrowers must stay informed about their rights and lender obligations.

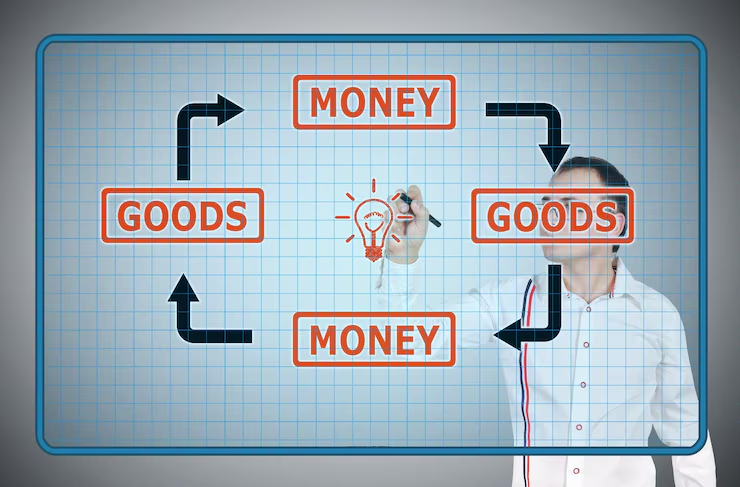

3. Key Bank Loan Products and Innovations

Loan Type Recent Innovations Typical Borrowers

Personal Loans Dynamic interest rates, flexible repayment Gig economy workers, freelancers

Mortgages Green incentives, virtual home buying First-time and eco-conscious buyers

Auto Loans EV financing options, usage-based pricing Buyers of electric/hybrid vehicles

Business Loans Revenue-based repayment, fintech partnerships Startups, small business owners

4. Risks and Challenges for Borrowers

Privacy Concerns: Increased data sharing elevates cyber risk exposure.

Potential Bias: AI algorithms may unintentionally discriminate.

Debt Overextension: Easy access to credit risks unsustainable borrowing.

Economic Instability: Rising interest rates and inflation can increase borrowing costs.

5. Borrower Best Practices for 2025

Monitor your credit score and report regularly.

Use fintech platforms to compare loan offers transparently.

Understand all loan terms and fees before committing.

Negotiate rates and repayment plans when possible.

Seek professional financial advice for complex loans.

6. Looking Forward: The Future of Lending

Wider adoption of open banking to enhance data sharing and product personalization.

Development of ethical AI to improve transparency and fairness.

Blockchain implementation for secure loan contracts and tracking.

Growth of sustainable and socially responsible lending products.

Conclusion

The U.S. bank loan market in 2025 presents both exciting opportunities and complex challenges for borrowers. By embracing technological tools, staying informed about regulations, and practicing prudent borrowing habits, individuals and businesses can secure the financing they need to achieve their goals responsibly and effectively.

.avif)

.jpg)

.png)

.jpg)