🇺🇸 USA Bank Loans 2025: Deep Dive Into Trends, Risks, and Smart Strategies

BynambiPublished 87 days ago

Introduction

In 2025, the landscape of bank loans in the United States continues to transform dramatically. Driven by technological innovation, evolving regulations, and changing economic conditions, borrowers face both new opportunities and complexities. Whether you are seeking a personal loan, mortgage, auto financing, or business credit, understanding the current environment is crucial for making wise decisions.

1. The Technological Revolution in Lending

Artificial Intelligence & Machine Learning

AI algorithms now evaluate borrower risk using diverse data sets — including traditional credit scores plus alternative indicators such as payment histories on utilities, rent, and even social data. This enables:

Faster, more accurate credit decisions

Expanded access for thin-file or underserved borrowers

Customized loan terms tailored to individual profiles

Yet, concerns about transparency and algorithmic bias remain critical.

Fully Digital Loan Experiences

From application through approval and funding, banks offer streamlined digital processes featuring:

Instant eligibility checks

Paperless document uploads

Electronic signatures and remote closings

This shift enhances borrower convenience but requires digital literacy and vigilance against cyber threats.

2. Regulatory Landscape & Consumer Protections

Regulators including the CFPB focus on:

Ensuring clear disclosure of terms, fees, and penalties

Regulating AI lending tools to prevent discrimination

Strengthening consumer data privacy under laws like CCPA and GLBA

Borrowers should stay informed about protections and rights in this evolving regulatory climate.

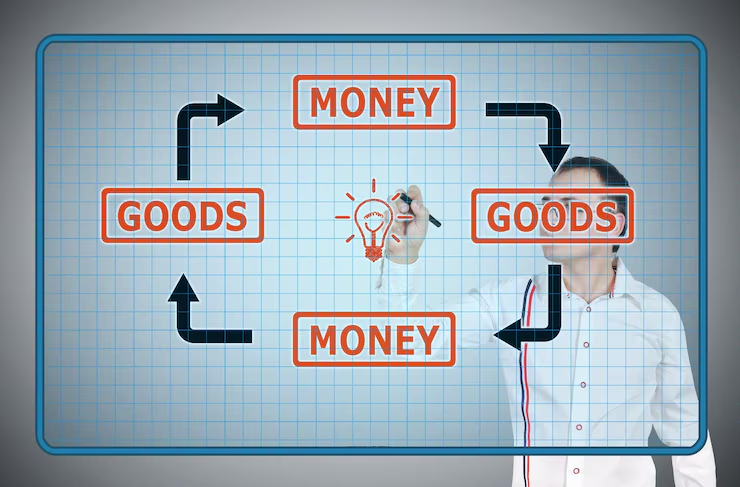

3. Bank Loan Products & Innovations in 2025

Loan Category Recent Trends & Innovations Typical Borrowers

Personal Loans Flexible repayment, risk-based pricing Freelancers, gig economy workers

Mortgages Green mortgages, virtual closing services First-time buyers, eco-conscious buyers

Auto Loans Usage-based pricing, EV financing options Buyers of electric and hybrid vehicles

Business Loans Revenue-based repayment, fintech collaborations Startups, small and medium businesses

4. Challenges and Risks for Borrowers

Privacy & Cybersecurity: Increased digital data collection raises risks of breaches.

Algorithmic Bias: AI models can unintentionally perpetuate inequities.

Debt Overextension: Easy credit access may lead to unsustainable borrowing.

Economic Volatility: Rising interest rates and inflation affect affordability.

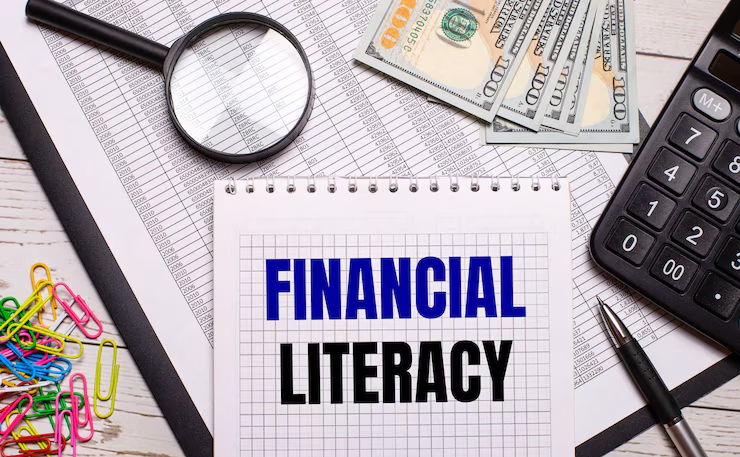

5. Strategies for Smart Borrowing

Monitor your credit reports regularly for accuracy.

Use online comparison tools and fintech platforms to shop loans.

Understand every term and fee before signing.

Negotiate interest rates and repayment schedules where possible.

Consult financial advisors for complex or high-value loans.

6. What’s Next: Future of Lending

Broader adoption of open banking for personalized financial products.

Development of ethical AI standards for transparency and fairness.

Blockchain-based loan contracts improving security and trust.

Expansion of sustainability-linked lending rewarding green initiatives.

Conclusion

The bank loan market in the USA in 2025 is dynamic and full of opportunity — but also complexity. Informed, cautious borrowing combined with the smart use of technology will help consumers and businesses alike harness financing options to achieve their goals sustainably.

.avif)

.jpg)

.png)

.jpg)