🇺🇸 Understanding USA Bank Loans in 2025: Trends, Challenges, and Smart Borrowing Tips

BynambiPublished 87 days ago

Introduction: The Modern Borrower’s Guide to Bank Loans

In 2025, obtaining a bank loan in the United States has become a blend of cutting-edge technology, regulatory complexity, and changing economic realities. Whether you are an individual looking for a personal or mortgage loan, or a business owner seeking capital, understanding the current landscape is critical to making informed financial decisions.

This article explores key trends shaping bank loans in 2025, outlines major risks, and offers actionable advice for borrowers aiming for success.

1. The Technology Revolution in Lending

AI-Powered Credit Evaluation

Banks increasingly use AI and machine learning to assess creditworthiness. Unlike traditional methods relying heavily on credit scores, these models incorporate:

Alternative financial data (e.g., utility, rental payments)

Behavioral data from digital footprints

Real-time income and cash flow analytics

This leads to faster decisions and expands access, especially for those previously underserved. However, borrowers should be aware of potential biases in automated systems.

Digitization and Seamless Experience

The loan application process has become predominantly digital:

Instant prequalification tools

Paperless document submission

E-signatures and digital contracts

These innovations reduce waiting times and improve customer experience.

2. Regulatory Environment and Consumer Protection

The Consumer Financial Protection Bureau (CFPB) and other regulatory bodies are focused on:

Transparency of loan terms and fees

Accountability in AI decision-making to prevent discrimination

Data privacy compliance under laws like the California Consumer Privacy Act (CCPA)

Borrowers should familiarize themselves with these protections and verify lender compliance.

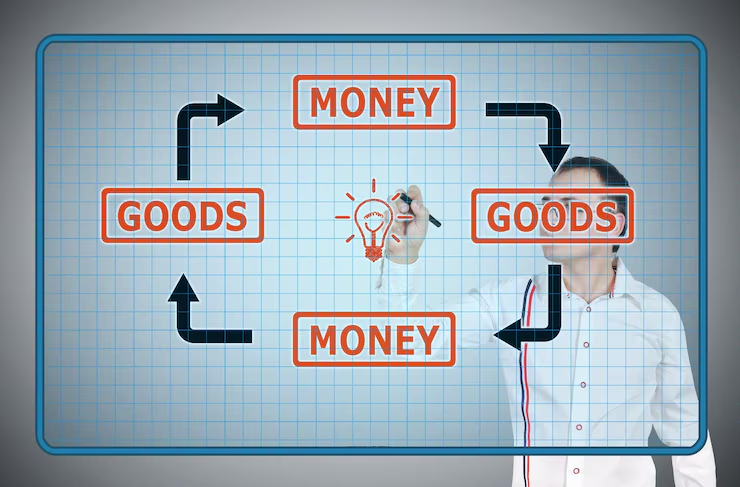

3. Popular Bank Loan Products & Their Innovations

Loan Type Innovations & Trends Borrower Profile

Personal Loans Risk-based pricing, flexible terms Freelancers, gig workers

Mortgages Green home incentives, virtual closings First-time buyers, eco-conscious buyers

Auto Loans EV financing, telematics-based pricing Electric and hybrid vehicle buyers

Business Loans Revenue-based repayment, fintech partnerships Startups, small and medium enterprises

4. Risks and Considerations for Borrowers

Privacy Risks: Broader data collection heightens cyberattack vulnerabilities.

Algorithmic Bias: AI models may unintentionally disadvantage certain groups.

Debt Accumulation: Easy credit access may lead to unsustainable borrowing, especially in inflationary contexts.

Economic Uncertainty: Interest rate hikes and economic shifts can tighten credit availability.

5. Tips for Smart Borrowing in 2025

Regularly review credit reports and maintain a strong credit score.

Use comparison tools and fintech platforms to evaluate loan offers.

Carefully read and understand all loan terms, fees, and penalties.

Negotiate loan terms whenever possible based on your creditworthiness.

Consider consulting financial advisors for complex or large loans.

6. What the Future Holds

Open banking initiatives enabling secure data sharing for personalized loan products.

Ethical AI frameworks to promote transparency and fairness in lending decisions.

Increasing adoption of blockchain for secure loan contracts and repayment tracking.

Expansion of sustainable lending products rewarding eco-friendly projects.

heir rights, and approach borrowing with discipline will

.avif)

.jpg)

.png)

.jpg)