🇺🇸 Bank Loans in the USA 2025: What Borrowers Must Know to Make Informed Decisions

BynambiPublished 87 days ago

Introduction

Bank loans continue to play a critical role in the financial ecosystem of the United States. As we move through 2025, the borrowing landscape is rapidly evolving with advances in technology, changes in regulations, and shifts in borrower needs. Whether you're seeking a personal loan, mortgage, auto financing, or business credit, understanding these changes is essential for making sound financial choices.

1. The Role of Technology in Modern Lending

AI-Powered Credit Evaluation

Artificial intelligence (AI) now evaluates borrower risk with greater precision, analyzing:

Traditional credit reports

Alternative data such as rent and utility payments

Behavioral and transactional data

This enables quicker decisions and personalized loan terms but raises concerns about transparency and fairness.

Fully Digital Loan Journeys

Digital tools allow borrowers to:

Apply online anytime, anywhere

Submit documents electronically

Receive approvals within minutes

Complete loan closings remotely

This convenience demands borrowers be vigilant about cybersecurity and data privacy.

2. Regulatory Focus in 2025

Government agencies emphasize:

Clear and transparent loan disclosures

Preventing discriminatory lending through AI oversight

Protecting consumer data privacy with laws like CCPA and GLBA

Borrowers should be aware of their rights and ensure lenders comply with regulations.

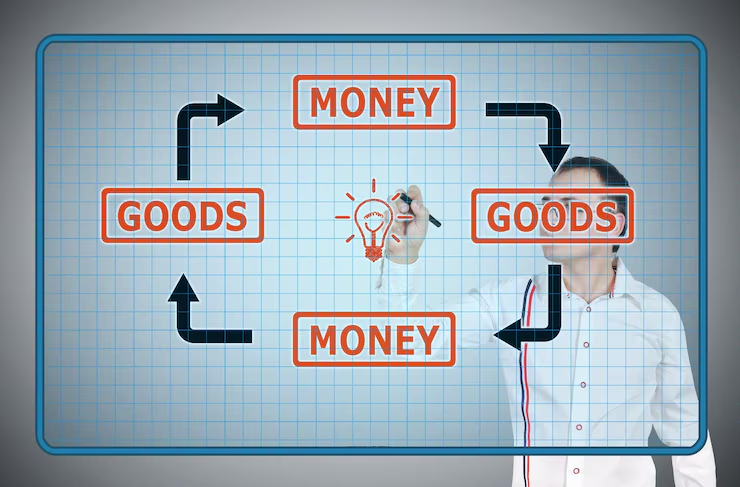

3. Popular Bank Loan Types and Innovations

Loan Type Notable Trends Typical Borrowers

Personal Loans Flexible repayment, risk-based pricing Freelancers, gig workers

Mortgages Virtual closings, green home loans First-time buyers, eco-conscious

Auto Loans EV financing, telematics-based rates Electric and hybrid vehicle buyers

Business Loans Revenue-based repayment, fintech collaboration Startups, SMEs

4. Key Risks and Considerations

Data Security: Increased data collection heightens breach risks.

AI Bias: Automated systems may unintentionally discriminate.

Debt Risks: Easy access to credit can lead to overborrowing.

Economic Factors: Interest rate hikes impact repayment costs.

5. Tips for Smart Borrowing

Regularly check your credit reports.

Use fintech platforms to compare loan offers.

Read all loan documents thoroughly.

Negotiate terms based on your credit profile.

Consult financial advisors when needed.

6. Looking Ahead: The Future of Lending

Expanded open banking for personalized financial solutions.

Enhanced AI ethics frameworks for fair lending.

Blockchain for secure, transparent loan contracts.

Growth in sustainability-linked loans promoting eco-friendly projects.

Conclusion

The bank loan environment in the USA in 2025 offers exciting opportunities driven by technology and innovation but also presents new challenges. Borrowers who stay informed, leverage digital tools smartly, and practice responsible borrowing will best navigate this evolving landscape and achieve their financial goals.

.avif)

.jpg)

.png)

.jpg)